From eBIZ Fashion Forum an open perspective for the fashion industry

64 experts from IT, Material Supply, Manufacturing, Brand, Retail, Associations shared their insights in an open and constructive atmosphere.

|

The challenge is a medium-term approach for the issues of the fashion industry that is threatened by monopolistic ePlatforms (i.e. Amazon and AliBaba), logic- and system breaks, lacking rules and incomplete best practices/standards and missing real time technologies and as a result increasing complexity of the processes in the omnichannel and customisation perspectives Launch of the “Initiative - Connection Textile Sector“ for creating a DIGITAL MASTER PLAN for the sector

The conference, hold in Frankfurt on September 19th 2018, was the point of arrival of the work launched by a collaboration between eBIZ 4.0 project (ebiz-tcf.eu), specifically ENEA, and GCS Consulting (GCS Consulting GmbH, München, Germany, schneider@gcs-consulting.de): the aim was to verify the potential of eBIZ for the German fashion industry and understand the industry requirements relevant within this country in a wider European perspective. The activity was structured on three steps: - market and business scenarios analysis in Germany on perspective of eBIZ and RFID technologies adoption (including interviews to a focus group of relevant stakeholders); - definition of a potential scenario for the adoption of eBIZ as part of a platform for the fashion industry in Germany - presentation of the study’s results and the potential scenario at the conference “eBIZ & GCS Fashion Forum” in Frankfurt in order to discuss its outcomes and get feedbacks.

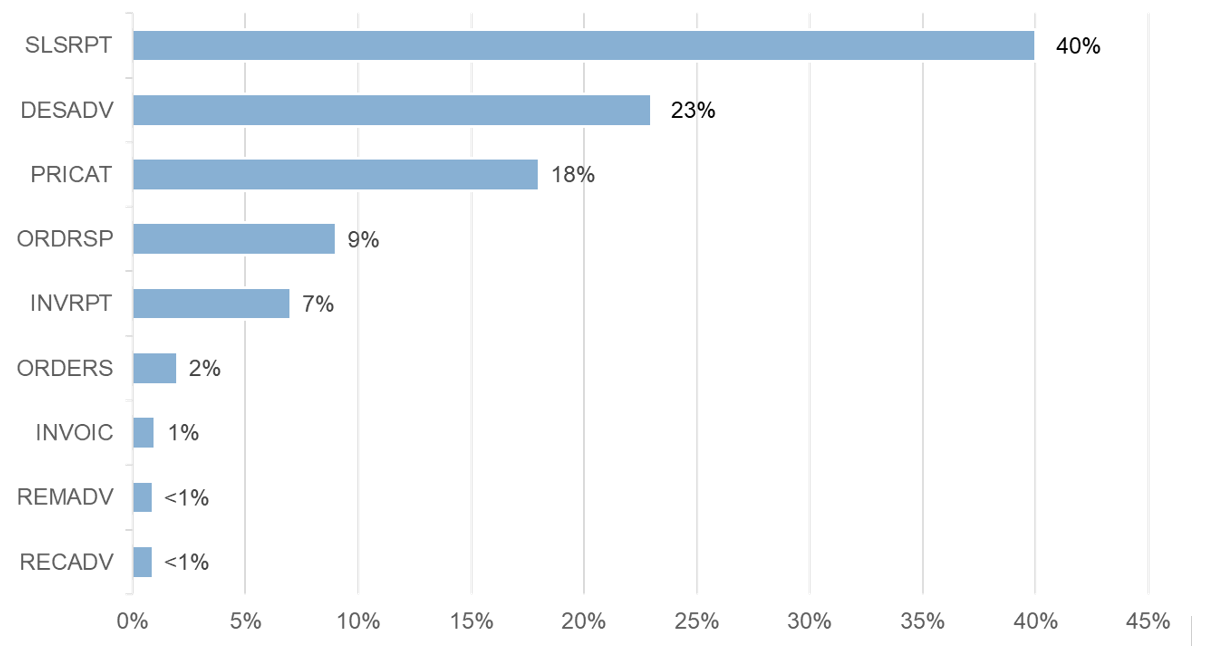

1. The market analysis evidenced that German Fashion industry is facing deep changes in the consumer behaviors (that lead towards a renaissance of product performance with a polarization of “price oriented” approaches versus “innovative, high quality products” orientation), an increasing complexity of the sales channels in a ‘Omnichannel’ perspective (new actors/systems like eCommerce platforms, Social Media Platforms, enriched shopping experiences systems multiply the customer touchpoints;...) and, more in general, the increasing complexity of the supply chain management that is stressed by delocalization, shorter delivery terms and product shelf life as well as demand for exclusive / customized products (part of such a picture is the traditional difficulty, for example, in the information flows with high quality materials suppliers like the Italian and Spanish suppliers). A second evidenced point is that EDI data flows (mainly EANCOM format) are in many cases in place but dealing with structured organizations mainly on the downstream side of the chain, from producers to retail organizations. Differently from other countries like Italy or Spain, the German industry has in some way invested on EDI technologies and has a strong perception of this legacy of investments and asks for a clear positioning of eBIZ (not so much known) and EDI/EANCOM: the clear message is that a competition between different standards is something to be avoided. Thus a third outcome is about the dissatisfactions and wish lists expressed by the panel of interviewed experts. The evaluation about the difficulties from the current EDI technologies might be summarized in

The requirements for a new approach:

Of course such a list of requirements is challenging because, as usual, the apparent simplicity for users requires a complex background of technologies, nevertheless it evidences the direction and the issues for the near future and that German Fashion companies are not happy with the present EDI/EDIFACT and are looking for an innovative approach. It is just to mention a last point about IT skills that are a part of the picture: small companies are missing skilled IT-staff in particular which is increasingly difficult to recruit (result of latest IT Benchmark 2018 by GCS Consulting GmbH for GermanFashion Modeverband e.V.)

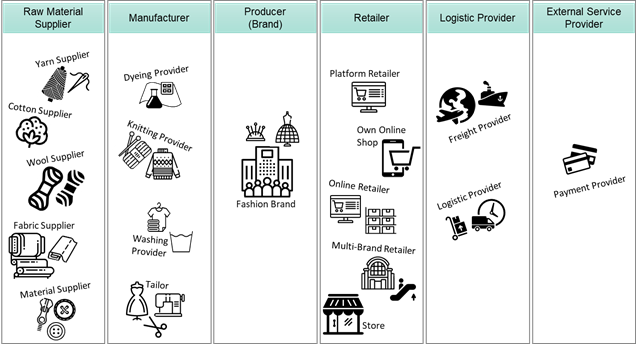

2. The proposition of a potential scenario comes from the analysis of the situation and challenges made by GCS. Fashion daily life is too complicated. Industry is facing a wild mix of functions, business models and specialized IT systems that are a big challenge. Fashion Supply Chain Network : almost no rules and few standardized interfaces. Networking is “trendy” and each company in a Multi-player Market is part of a network, but networks work well only with clear structures and defined interfaces. Particularly in complex, multi-player networks we are only a small step to chaos. Network structures without clear rules have little strategic value! Challenges and daily complexity today:

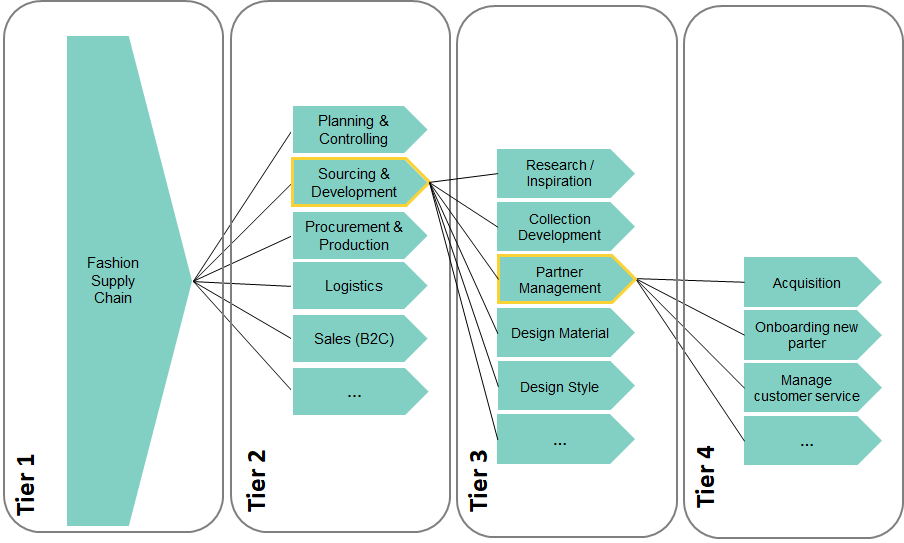

Despite the very little focus on external collaboration processes in the German fashion industry , there is a very relevant activity in a completely different sector that might ‘infect’ also the fashion industry in the next years: automotive industries already have standards for supply chain data exchange but now are looking a completely new uniform communication structure: the complete digitalization of the Industrie 4.0 paradigm leads toward the definition of the Reference Architecture Model Industry (RAMI 4.0). In this perspective we should ask us if the solutions for the fashion supply chains should be a simple evolution of the existing options or should be viewed within a wider landscape that includes many points of views and should integrate completely different fields (from floor automation up to SCM and ePlatforms and social media). On this purpose at the conference GCS has proposed an approach based on a holistic analysis of the current business processes inside the fashion industry, with the aim to understand duplications, bottlenecks but also to define the scope of a possible work. The result of such analysis, presented at the conference is that structuring the business processes into 4 hierarchical levels it has been possible to identify 216 business processes that are necessary for the transformation of fibers like cotton into a final product on the shelf, where 102 are internal only while 114 are processes involving external functions, more than 50%.This creates a structured and therefore calculable base allowing to develop simple solutions for a creative and currently very complex Textile Sector world. For these processes the evaluation is that criticalities arise from a combination of the following:

How is positioned eBIZ in such a situation? While eBIZ has a Historical “Upstream DNA”, with eBIZ 4.0 project the “garment” segment has been significantly improved (so far no “Omni Channel” support today); thus Upstream more operational data content are supported in respect of EDI. Furthermore eBIZ is thought to support exchange between ‘functions’ inside the different organisations: one company might have inside both the ‘Producer’ function as well as the ‘Supplier’ function or not. From a technological point of view eBIZ in Germany has a technology that requires less “individualization” before its adoption and much less necessity for the traditional EDI converters (eBIZ speaks of almost “ready to use interoperability”). For example a “use profile” mechanism allows working without converter and achieving real interoperability in a short time. On the other side eBIZ is less known than EANCOM and, up to now, has not the organizational supporting infrastructure based on global presence like e.g. GS1. The analysis points out that neither EDI/EDIFACT(incl. GS1 XML) nor eBIZ nor RAMI are perfect and none of the three choices cover all necessities that the German experts (interviewed or participating the conference) were demanding. Nevertheless, eBIZ is the closest though of the 3 choice, thus may be considered first choice as a base to start from, at least regarding all open issues that are not related to a new basic technology for real time data exchange – which is currently the biggest challenge and the biggest question mark! In other words, covering external processes with suboptimal or totally missing best practise solutions is recommended to be based on eBIZ, because eBIZ:

Some areas were suggested as a priority with big potentials and a significant urgency to act:

As a logic result the production sector in Textile/Fashion should see a strong movement towards speed-oriented supply chains including individualization trends so today’s pain with insufficient quality of the external processes will even increase and will determine in the near future the survival chances of significant parts of the Textile Sector.

3. The conference The conference was the occasion for GCS and eBIZ for presenting the outcomes of the analysis of the industry situation, the eBIZ potential role and for proposing a methodological approach based on business processes detailed analysis with the aim of getting feedbacks from the debate.

Some short presentations come from invited speakers. Mauro Scalia, EURATEX, stressed the importance of digitalization in fashion industry that is characterized by a large amount of small and micro factories; he answered the question “Why do we need more eBIZ ?” by recalling that, beyond business needs, there are requests for voluntary traceability, policy pressures to transfer information across the value chain (e.g. : chemicals of concerns, due diligence practices) and there is no digitization without harmonization. Two presentations from Hugo Boss reported its experience of adoption of eBIZ for connecting suppliers in many countries that is at the beginning but with positive feedbacks and the future directions for widening the field of application of the digitalization with the suppliers. Piero De Sabbata, ENEA, started from a statement “[companies] have invested a lot of money on optimized supply chain management and planning systems, now should invest a bit to get the INFORMATION they need to make them WORK ...” to stress that the focus for eBIZ is fully exploit Internet technologies to get better Quality information for inter-organization Collaborations. Secondly he evidenced the necessity for tools that might be ‘ready to use’ for interoperability (see slides). Speaking about where eBIZ is and where is going he mentioned some key points:

Reported experience: eBIZ already supports Data Flows to create Catalogues, Customers’ database, and manage orders in some B2B portal (for example ready in stock service, based on Magento)

Reported experience: near real-time (2 minutes reaction between 2 different cities) collaborative scheduling between TWO schedulers (case of Yarn mill CARIAGGI and its subcontractor for dyeing) Another reported experience: RFID on the conveyer at the subcontractor plant and sending of production order advancement through eBIZ (case of Shoes manufacturer Quadrifoglio)

After these introductory framework the debate was launched managed by Andreas Schneider, GCS. The first surprising insight was, that most of the participants had a similar view of the problem landscape challenging currently the whole Textile Sector: system- and logic-breaks – competing standards – high complexities – significant cost cutting potential – too many specialized systems – digitalization of the “old world”. The conference also showed that the old “upstream-downstream” attitude needs to be replaced by thinking in “consumer driven value chains”. During the discussion several participants gave praxis examples of using the eBIZ reference architecture (like Lanificio Marzotto and the software house Kyklos) and, in general, agreed on some points:

Then the discussion was around the following questions around the idea of a Digital Master Plan:

A Digital Master Plan in this context is seen as a set of rules defining roughly where the Textile Sector wants to move by joint Goals and regarding Processes, Best Practices, IT Tools and Basic Technologies. This includes the building of “critical mass” where necessary and the new idea of an early, systematic adoption of relevant developments into as many IT Solutions as possible - resulting in improved adoption speed for the whole sector. In the conclusion of the conference GCS Consulting presented cornerstones for an Initiative – Connecting Textile Sector for implementing best practices by founding communities, including associations and significant stakeholders and combining activities with a joint master plan. GCS also described goals, conditions and a (draft) workgroup and Steering Committee structure as work environment – based on a crowd funding approach with a minimum of 40 participants that will be evaluated by participants after the conference. The eBIZ 4.0 project on the other side will examine carefully the outputs from the conference and the positive reactions to the general view of eBIZ and will keep them into account in its next steps, the first of them will be the release of a eBIZ 4.0 2018 version with a lot of improvements. |

|

Resources | ||

|

||

|

||

|

||